SRQ DAILY Sep 13, 2014

"Older development gets a larger percentage of the non-assessed value property tax break. Newer development pays taxes on more of what their properties are actually worth."

The Sarasota 2050 review process has been characterized by some opponents as being driven by developer-funded interests intent on unleashing unbridled, taxpayer-funded growth east of I-75. On numerous occasions, in print and in public comment, changes to the plan are implied to undermine taxpayer protections to the degree where new development will be funded by current taxpayers.

What is absent from any of these conversations is how much property taxes are generated from new development.

In 2013, there was roughly $31 billion in taxable non-vacant residential property value located in Sarasota County. Of that, about 21 percent was generated by residential parcels developed in the preceding decade (2003-2012). While that time frame included years with some of the highest production Sarasota County has ever seen, it also included years with some of the lowest production. In fact, when staggering decades beginning in 2013, the 10-years between 2003 and 2012 stand as the lowest producing decade since 1963-1972.

If one looks at the most recent 20-year period, which isn’t unreasonable when considering development, new development between 1993 and 2012 accounts for roughly 44 percent of the entire residential non-vacant property tax base. That means that nearly half of Sarasota County’s property tax revenue comes from parcels developed fairly recently. It’s important to note that while these parcels contribute 44 percent of the tax base, they only comprise 33 percent of the total parcels.

Another concept to consider is a property’s non-assessed value. There are several different values that are relevant when reviewing property taxes. The first is the just, or market value; this is the value of the property if it were to be sold on the open market. The second is the assessed value; this is the value of the property based on the administration of Florida Statutes governing property taxes. The third is the taxable value; this is the assessed value minus any applicable exemptions (e.g., homestead) and is the value that property taxes are actually derived from.

The non-assessed value, then, is the difference between what the property appraiser estimates the value of a property to be on the open market (i.e., market value) and the starting value that is used to calculate property taxes (i.e., assessed value). Basically, non-assessed value is a tax break. It’s a portion of the market value of a property that an owner does not pay taxes on. In 2013, there was roughly $3 billion of non-assessed residential property value in Sarasota County. That non-assessed value would have generated over $10 million in property tax revenue if it were included in the taxable value. 70 percent of that non-assessed value existed in homes built prior to 1993, and 86 percent of it existed in homes built prior to 2003.

Older development gets a larger percentage of the non-assessed value property tax break. Newer development pays taxes on more of what their properties are actually worth. There is, not surprisingly, an important caveat to this.

Because of how Florida Statues are structured, non-assessed value is often decreased or eliminated when a property is sold. Non-assessed value in general will, over time, increase as a property remains in the hands of a single owner. That is the result of a Florida Statue that restricts assessed value from increasing more than 3 percent per year, regardless of what happens to the market value.

Of the $31 billion in taxable non-vacant residential property value located in Sarasota County, 58 percent existed in homes that were last sold in the decade extending from 2003-2012. Those properties comprise only 56 percent of the total parcels and carried only 43 percent of the non-assessed value in the County.

Older home sales get a larger percentage of the non-assessed value property tax break. Newer home sales pay taxes on more of what their properties are actually worth.

The link here is that a greater portion of the tax base is propped up by either new homes built or old homes newly sold. Like in the case of sales tax, the property tax base is greatly supported by actual activity. It’s stagnation that depresses a tax base, not activity.

The public should be aware that developers are not “pickpocketing taxpayers” as new neighborhoods are built. When it comes to property taxes, the facts tell a very different story: if a community wants to maintain a healthy property tax base without raising rates or rising property values, both of which come on the backs of the current taxpayer, it needs economic activity in the form of new homes built, and older homes newly sold.

SRQ Daily Columnist Kevin Cooper is the vice president for Public Policy and Sarasota Tomorrow Initiatives for The Greater Sarasota Chamber of Commerce

There are three constitutional amendments that will be on the ballot this November. Both Amendment One, the Florida Water and Land Conservation Initiative, and Amendment Two, Florida Right to Medical Marijuana Initiative, are initiated constitutional amendments - 683,149 signatures from at least 14 of the state’s 27 congressional districts were collected of Florida residents. The Third Amendment, Florida Prospective Judicial Vacancies, is on the ballot because it received a sixty percent majority vote in both the legislative chambers via a joint resolution. To be approved, these amendments must garner a supermajority – at least 60 percent or more of the vote.

Amendment One: Florida Water and Land Conservation Initiative

This amendment would create a fund that is designed to acquire land for preservation, manage and restore natural systems, and to enhance public access and recreational use of conservation lands.” For the next 20 years, 33 percent of net revenues from the existing excise tax on documents would be placed in this fund every year. This will become the law and no longer subject to the state budget every year.

If there is a concern, it is that the state legislature would place less of an emphasis on Florida Forever, a fund already in place that is used to acquire environmentally sensitive lands. The difference is that there is no requirement to fund Florida Forever, as seen in 2011 during the first year Governor Scott was in office. ZERO dollars were dedicated to the fund. Amendment One would prevent that from happening.

Amendment Two: Florida Right to Medical Marijuana Initiative

Ballotpedia states the law is defined:

- That medical use of marijuana by a qualifying patient or personal caregiver is not subject to criminal or civil liability or sanctions under state law.

- That a licensed physician is not subject to criminal or civil liability or sanctions for issuing medical marijuana to a person diagnosed with a "debilitating medical condition" under state law.

- That registered medical marijuana treatment centers are not subject to criminal or civil liability or sanctions under state law.

The Florida Department of Health would help regulate the practice of the law by issuing patient and care giver ID’s, the amount of marijuana used for medical reasons, and patient confidentiality. But the true regulation would come from the State and local government. Even before the law is voted on in November, local governments are already deciding whether to “opt in” and allow for dispensaries, growers and distributors in their community.

A major concern is the ambiguity of this amendment. With fear of a loose interpretation, citizens and bombarded with fear mongering and misinformation of how it will be put into practice. Can a chiropractor really issue a prescription for medical marijuana? Will there really be a dispensary on every corner like it is out in California? The answer is no. Unless our state legislature wants it to be that way. Because if the amendment passes, they will get to define how it is implemented and how it is used.

Amendment Three: The Florida Prospective Judicial Vacancies

This amendment decides whether the outgoing or the incoming governor gets to fill the vacancies of the State Supreme Court that coincide with the end of the current governor’s term.

It’s really pretty simple, on January 8, 2015, three judges will be retired due to mandatory age retirements. If you vote “yes” to this amendment, then Rick Scott will get to make the appointment. If you vote “no,” and Rick Scott loses this election, then the new Governor will get to make the appointment. The next three appointments will have a tremendous effect on the direction of the State Supreme Court.

Vote Wisely.

SRQ Daily Columnist Susan Nilon is the president of Florida Talk Radio and owner of WSRQ Radio. She hosts The Nilon Report on WSRQ Sarasota 1220AM/106.9FM weekdays 4pm-6pm. Email her at susan@sarasotatalkradio.com.

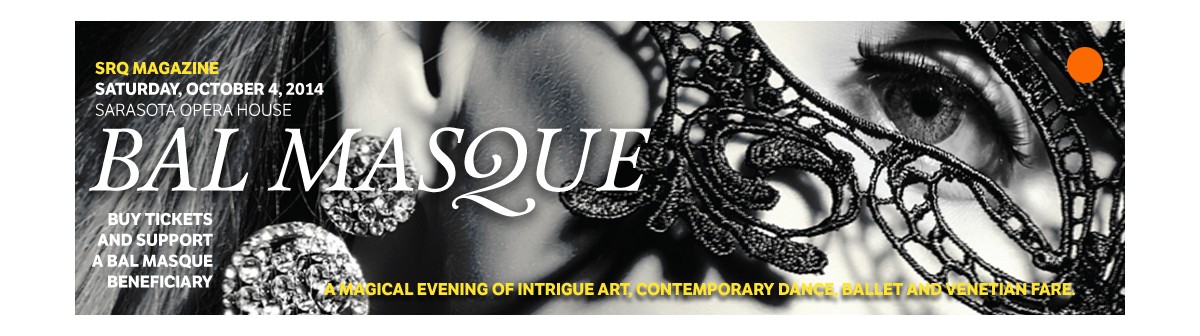

Our inaugural signature soiree, Bal Masqué, is SRQ The Magazine’s biggest event of the year. Your all-inclusive ticket includes your donation to one of our event beneficiaries, cocktails, dinner and amazing performances. Introduce your palette to Venetian fare from Fête, wine from The Bijou Café, and cocktails from Siesta Key Rum and Tito’s Handmade Vodka before the performances from the Circus Arts Conservatory, Fuzión Dance Artists, and Sarasota Cuban Ballet School, begin at 10pm. Don formal attire with a Venetian masquerade twist and get excited for a magical evening at the Sarasota Opera House. Get your ticket and select your beneficiary from: the Circus Arts Conservatory, Child Protection Center Inc., Suncoast Charities for Children and Suncoast Science Center. This years Bal Masqué is dedicated to children. #srqbalmasque

The Resort at Longboat Key Club and USF Sarasota-Manatee (USFSM) recently announced a key regional partnership and new training program for USFSM students. As the official “Teaching Hotel” for the College of Hospitality & Technology Leadership, the Resort will be the site of The Teaching Lab program that will accommodate hospitality students each semester in a rotation that includes operational and administrative divisions of the Resort and Club. The inaugural program will allow students to shadow key leaders at the resort through Leadership, Front Desk, Housekeeping and Food & Beverage operations giving them “real-time” access to the processes and protocols of successfully managing these critical areas in a hospitality setting. Each student will be expected to spend a minimum of four hours in the four departments for a total of 16 hours of on-site training. Students will be required to write a reflection paper at the end of the training period. They will also be required to attend the resort’s mandatory Associate Orientation Program prior to their training tenure. The inaugural group of students will arrive at the resort on September 16, 2014. It is anticipated the program, which begins with 23 students, will be expanded over the course of the upcoming semesters to include areas of Lodging Management and Restaurant Management.

Veterans Jobs Fair Goodwill Manasota and Career Source will host the second annual Veterans & Their Families Jobs Fair on September 19 from 9am to 12pm. The event will be held at Goodwill Manasota’s new corporate campus, located at 2705 51st Ave E in Bradenton, off US 301. Previously, the jobs fair had included booths from veterans’ services and educational sources as well as employers; however, this year, the fair will focus on employers only. “We have asked that all employers present will have jobs available, and that they are looking to hire veterans,” said Margie Genter, Goodwill Manasota VP of Mission. “We realized that our veterans were much more interested in finding employment, as that is an immediate need.” Nearly 40 employers are expected to be in attendance at the jobs fair. For more information on the Jobs Fair, contact Don Hill at (941) 355-2721, ext. 454 or email don.hill@gimi.org.

For one weekend only, The Sahib Shrine Circus will perform at the Circus Arts Conservatory. On October 3- 4t the Sailor Circus Arena will be home to three performances that are guaranteed to entertain circus fans of all ages. The action-packed show kicks off with Joseph Bauer, Jr., a celebrated Ringmaster, 17th generation circus performer and renowned daredevil star of the Bauer's Circus Maximus, who will join the performance line-up with his Wheel of Destiny. Noe España and family will perform including mind-blowing acts including contortion from daughter, Noemi, unbelievable head-balancing trapeze from his wife, Vivien, superior Chinese yo-yo from his son, Elan and thrilling motorbike stunts on an incline wire from Noe himself. There will be hilarious clowning from the Sahib Shiners and awe-inspiring aerial acrobatics from our hometown Sailor Circus students. Nationally-acclaimed Jennifer Walker Herriott will amaze with her talented steeds and exotic animals. Neecha Braun provides tail-wagging entertainment with her prancing pups, and juggler-extraordinaire, Vladimir Tsarkov will keep the cheers coming. "It's going to be a really awesome performance that everyone will enjoy," promises Pedro Reis, Circus Arts Conservatory Co-Founder and CEO.

In an effort to end the sex trafficking and slavery of minors in the United States, a new national campaign, Everyone’s Kids, Everyone Gives (EKEG), has united more than 100 nonprofits, including Ark of Freedom, a Sarasota-Manatee based anti-trafficking organization. The goal is to raise $1 million in 24 hours on September 16 through online giving. Every year, more than 100,000 American children are trafficked within the United States, a harrowing figure of which many Americans are still unaware. The American sex trafficking industry is one of the fastest growing criminal industries in the U.S., worth 3 billion dollars each year. In partnership with the leading crowdfunding platform, Razoo.com, supporters can donate directly to Ark of Freedom and other anti-child sex trafficking nonprofits on September 16 or schedule their donations in advance.

SRQ DAILY is produced by SRQ | The Magazine. Note: The views and opinions expressed in the Saturday Perspectives Edition and in the Letters department of SRQ DAILY are those of the author(s) and do not imply endorsement by SRQ Media. Senior Editor Jacob Ogles edits the Saturday Perspective Edition, Letters and Guest Contributor columns.In the CocoTele department, SRQ DAILY is providing excerpts from news releases as a public service. Reference to any specific product or entity does not constitute an endorsement or recommendation by SRQ DAILY. The views expressed by individuals are their own and their appearance in this section does not imply an endorsement of them or any entity they represent. For rates on SRQ DAILY banner advertising and sponsored content opportunities, please contact Ashley Ryan Cannon at 941-365-7702 x211 or via email |

Powered by Sarasota Web Design | Unsubscribe