Community Banks to Fill Lending Void?

Todays News

SRQ DAILY MONDAY BUSINESS EDITION

MONDAY JUL 27, 2015 |

BY JACOB OGLES

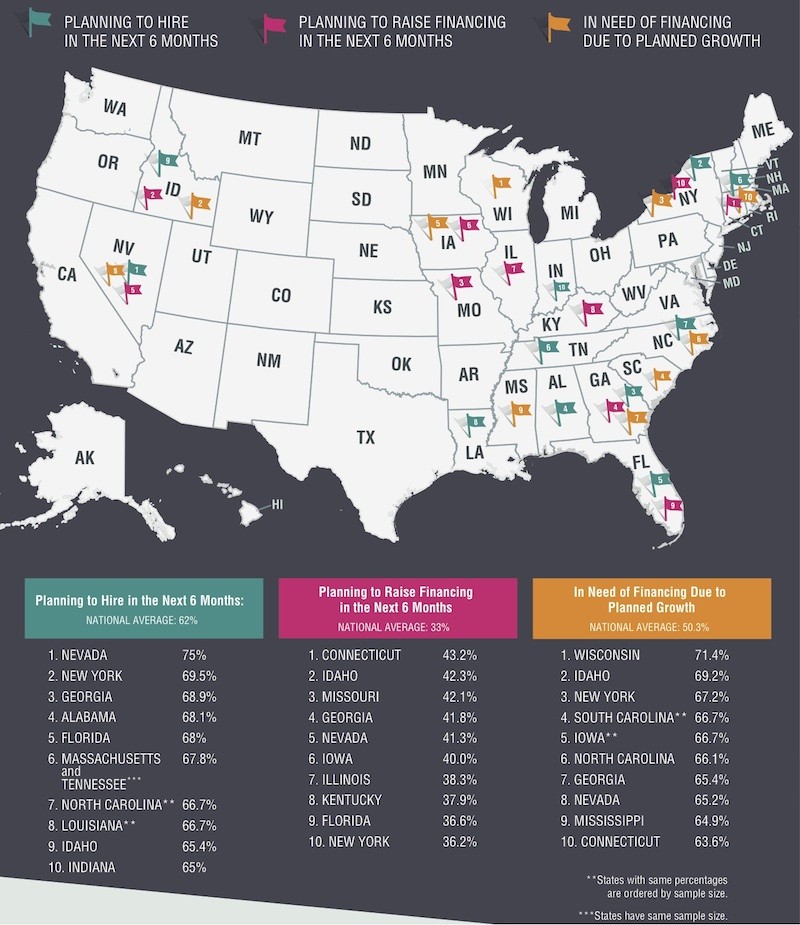

Graphic from Dun and Bradstreet Credibility Corp.

A new study from Dun and Bradstreet and Pepperdine University says greater demand exists in Florida for small business loans than in other states, but a lower percentage of loans are approved. Community banks in Southwest Florida, though, say they have been busy lending, and believe small banks will meet the demand. “The vast majority of small business loans that are made are by community banks,” said Shaun Merriman, president and CEO of Gateway Bank of Southwest Florida.

The Pepperdine study released this month shows small businesses (defined as those with under $5 million in revenue) have seen loans approved less than half the time every quarter dating back to at least the second quarter of 2012, and while things appeared to be improving in mid 2014, each quarter this year has seen a decline. In Florida, a higher percentage of businesses are planning for expansion in the next six months. But of the 41 percent who attempts bank loans in the second quarter this year, only 19 percent were successful, compared to 37 percent of businesses nationwide who were successful at obtaining the loans.

For what it’s worth, that’s an opposite experience to what Charles Brown III, chairman and CEO at Insignia Bank, has seen on the Gulf Coast, at least as far as approval rates. “I’ve had to hire more lenders than at any time in our history,” Brown said. “We are seeing more high-quality borrowers and are starting see our competition pick up as well. We’ve been clipping along for over a year now at a much more rapid pace than the year before.” But that could be because Insignia is a small community bank, Brown said. The Pepperdine study may reflect a tendency of national and large regional banks to back away from small business lending, which then directs business down to the community bank level.

Merriman said the reason the stats may play out as they do is because many small companies are new companies. “When a business is growing it puts a lot of stress and strain on capital needs, and those businesses tend to have a higher revenue-to-tangible debt ratio,” he said. So it makes some sense it’s more difficult for businesses with less than $5 million in revenue to secure loans. But he said Gateway, like Insignia, does a great deal of business with the small business sector. Indeed in the Sarasota area, some 95 percent of business are in that sector. That means regional and large banks that don’t specialize in small business spending may be reticent to give loans, but banks that do specialize in small business will likely approve loans at a better rate than reflected in the Pepperdine study, Merriman said. “Those establishments with less than $5 million in revenues, we love them,” he said. “That’s what we do. It’s our bread and butter in this bank.”

Graphic from Dun and Bradstreet Credibility Corp.

« View The Monday Jul 27, 2015 SRQ Daily Edition

« Back To SRQ Daily Archive